Let’s be real for a second. Trading is hard enough. You spend hours analyzing charts, backtesting strategies, and managing your psychology. The last thing you want to worry about is your infrastructure failing you at the worst possible moment.

But here is a question most retail traders ignore: Is the IP address you are using to connect to your broker actually safe?

Most beginners just grab any cheap VPN or VPS without asking if they are getting a Dedicated IP for Trading or if they are sharing that IP with 500 other strangers. This tiny detail is often the difference between a smooth execution and a “frozen account” email from your broker or Prop Firm.

Today, we’re going to pull back the curtain on the “Shared vs. Dedicated IP” debate and why, if you are serious about your capital, you need a dedicated footprint in Frankfurt.

What is a Dedicated IP (and Why Should You Care)?

In simple terms, an IP address is your digital home address. When you use a standard VPN or a low-quality VPS, you are essentially living in a crowded “Digital Dormitory.” You and hundreds of others are exiting to the internet through the same door (the same IP).

A Dedicated IP for Trading is like having your own private villa. No one else has the key. No one else uses that address. When you connect to Binance, MetaTrader, or your Prop Firm dashboard, they see only you.

The “Bad Neighbor” Effect: The Hidden Danger of Shared IPs

Imagine you share an IP with 200 other people. One of them decides to use that IP for malicious activities—spamming, DDoS attacks, or trying to hack a financial exchange. What happens?

The exchange (like Binance or Coinbase) doesn’t just ban that person; they blacklist the entire IP. Suddenly, your account is flagged as “High Risk” simply because you were sharing the same digital air as a bad actor. I’ve seen traders lose access to their funds for weeks while trying to prove to a broker’s compliance team that they weren’t the ones doing the “bad stuff.”

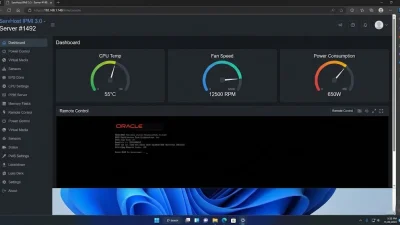

With a Frankfurt VPS from SarvHost, every account gets a fresh, clean, Dedicated IP. You are never responsible for someone else’s mistakes.

Why Prop Firms and Brokers Love Dedicated IPs

If you are trading with Prop Firms like FTMO, MyFundedFX, or even standard brokers, they have sophisticated anti-fraud systems. They look for “Account Sharing” or “Multi-Accounting.”

If their system sees 10 different accounts logging in from the same IP address at the same time, they assume one person is managing all those accounts (which is usually against the rules). They don’t ask questions; they just terminate the accounts.

By using a Dedicated IP for Trading, you ensure that your digital signature is unique. It looks professional, it looks stable, and most importantly, it looks like a single, legitimate business operation.

Performance: The Frankfurt Advantage

We’ve talked about security, but let’s talk about speed. Most major European exchanges and liquidity providers have their servers in Frankfurt, Germany.

When you use a shared IP (especially from a VPN), your data has to go through a “load balancer” or a “gateway” that handles thousands of other people. This adds Latency. In the world of high-frequency trading or news trading, a delay of 50ms can cost you hundreds of pips in slippage.

Our Frankfurt nodes are optimized for low-latency routing. Because your IP is dedicated, there is no extra processing layer. Your data goes from your VPS directly to the broker’s execution engine. It’s as close as you can get to sitting inside the exchange building.

How to Check If Your IP is Truly Dedicated (Tutorial)

Don’t just take a provider’s word for it. You can test this yourself. Here is a simple 2-step process to verify your setup:

1. The “What Is My IP” Test

Login to your VPS and open a browser. Go to ip.me or whatsmyip.org. Note down the address. Restart your VPS. If the IP changes, it’s a Dynamic IP (Dangerous for trading). If it stays the same, it’s Static.

2. The Blacklist Check

Take your VPS IP address and go to MXToolbox Blacklist Lookup. Paste your IP. If you see dozens of red marks, you are on a shared, “dirty” IP. If it’s clean (green), you have a professional-grade dedicated IP.

Dedicated IP vs. Shared IP: At a Glance

| Feature | Shared IP (VPN/Cheap Host) | Dedicated IP (SarvHost VPS) |

|---|---|---|

| Risk of Blacklisting | High (Bad Neighbor effect) | Zero |

| Broker Account Safety | Risk of “Account Sharing” flags | 100% Secure & Professional |

| Connection Stability | Can drop during peak hours | Always reserved for you |

| Latency (Ping) | Higher (due to routing layers) | Ultra-Low (Direct routing) |

| Price | $2 – $5 | $6 – $15 (The cost of a trade) |

Stop Saving Pennies to Lose Dollars

I get it. Everyone wants to save money. But let’s look at the math. A pro-grade Dedicated IP for Trading on a Frankfurt VPS costs about $6 to $10 a month. That is literally the cost of one single pip on a standard lot trade.

Is it worth risking a $50,000 Prop Firm account or a $10,000 personal account just to save the price of a sandwich? Professional trading requires professional tools.

At SarvHost, we don’t just give you a server; we give you a clean, dedicated, and anonymous footprint in the heart of Europe’s financial capital. No KYC, no shared “garbage” IPs, just pure performance.

🚀 Get Your Dedicated Frankfurt IP Now

[…] Shared IPs can sometimes be throttled or “blacklisted” by brokers. A Dedicated IP ensures a clean, direct tunnel between you and the liquidity provider. Learn more about this in our guide on Why Traders Need Dedicated IPs. […]